Who Benefit From Steong Ringgit

Ringgit notes are seen at a money changer in Kuala Lumpur June 20 2018. Ringgit notes are seen at a money changer in Kuala Lumpur June 20 2018.

Ringgit Opens Higher On Strong Commodity Prices Free Malaysia Today Fmt

For the time being expect the ringgit to remain weak near its current level he added.

Who benefit from steong ringgit. As such earnings growth of the only two public listed private. The ringgit was traded stronger against a basket of major currencies. Such a move could push up the weighting of ringgit sovereign notes by 08 percentage points to almost 10 in a JPMorgan emerging bond index Goldman Sachs Group Inc.

Meanwhile the ringgit was traded mixed against other major currencies. The Malaysian government would benefit from strong oil prices allowing the smooth implemenation of expansionary fiscal. Private healthcare players are expected to benefit from a stronger ringgit this year which will help stabilise operating costs while demand for private healthcare services should remain robust with hospitals anticipated to experience a steady increase in inpatient admissions.

Meanwhile the ringgit was traded higher against a basket of other major currencies. The Ringgit is strengthening I will list down a few stocks that benefit from stronger Ringgit hopefully you can help me add to the list. We expect the ringgit to stay within RM420.

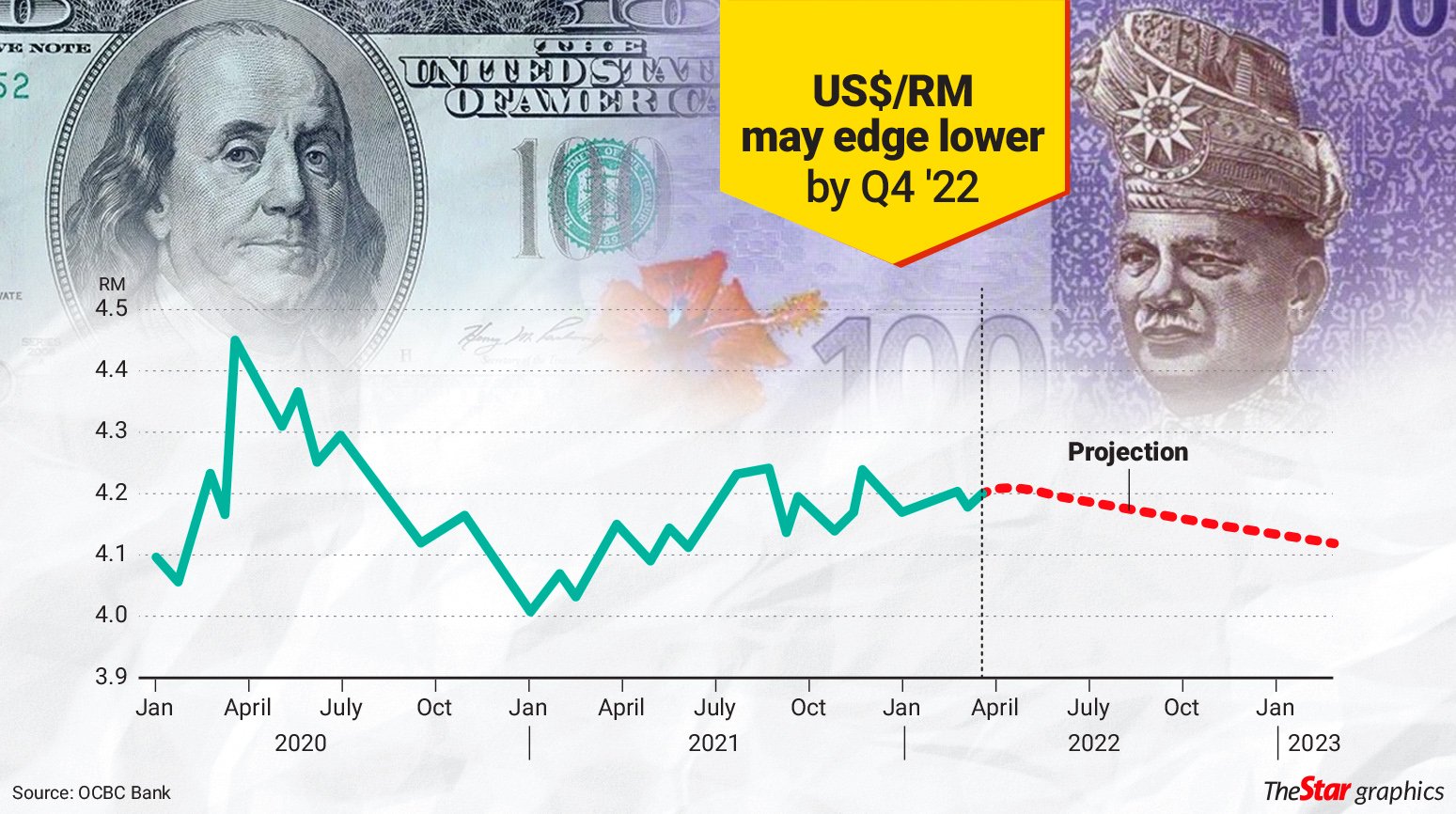

It rose against the Singapore dollar to 309921018 from 310621104 at the close yesterday and appreciated vis. While many are expecting a strong US dollar in the near term of three to six months this US dollar rally may sustain well into the first half of 2022 with the ringgit weakening to 430 against the dollar by the first quarter of 2022 said RHB Bank Bhd group chief economist and head of market research Dr Sailesh K. Meanwhile the ringgit was traded mixed against a basket of other major currencies.

However the higher Brent crude may limit the extent of ringgit weaknesses given that it may benefit the countrys economy Mohd Afzanizam noted. The ringgit opened slightly weaker against a stronger US dollar after the latest strong economic data amid rising inflationary pressures further suggested that the US Federal Reserve is on track to gradually remove monetary policy accommodationAt 9am the local currency had declined to 420552090 versus the greenback. However the upside bias for ringgit could come from crude oil prices which strengthened further following geopolitical risks he continued.

Malaysian bonds may also benefit from JPMorgan Chase Cos decision to drop Russian securities from its gauges. Rubber glove manufacturers to benefit from Covid-19 and weaker ringgit TheStar Thu Mar 05 2020 0845am - 1 year View Original KUALA LUMPUR. The local unit appreciated against the British pound to 569196953.

HONG KONG Jan 28. Said in a Feb. It will heal some of their headaches at least temporary until after the election.

The ringgit was traded stronger against a basket of major currencies. Both higher crude oil and strong ringgit will greatly reduce the fuel subsidy. Meanwhile the ringgit was traded higher against a basket of other major currencies.

A strong ringgit for example will dampen returns on stocks outside Malaysia. Thai baht is in a stronger position than Malaysian ringgit. KUALA LUMPUR March 15.

LOS ANGELES Feb 25 The ringgit recovered against the US dollar at the opening today as higher commodity prices may have averted further declines although heightened global geopolitical tensions continued to weigh on investor sentiment and support the US dollar. The ringgit is on course for its largest two-day gain vs USD since Jan. As net exporters of crude oil liquefied natural gas and crude palm oil the Malaysian economy would benefit from the current trend which could help boost key sectors such as oil and gas as well as plantations.

Strong ringgit also will make import goods less expensive and in theory imported food and materials prices should be. Strong presence in key Indian cities According to Sharekhan in key cities like Chennai Bangalore Hyderabad and Kolkata it owns sizeable market shares of 30 29 30 and 22 respectively. 4 in line with the broader strength in Asian currencies that Mark Cranfield highlighted.

It appreciated against the Japanese yen to 355775609 from 356665690 at Mondays close and climbed against the British. As such the ringgit is expected to move in a tight range next week. Compounding matters a weaker ringgit is likely to further erode the margins of manufacturers that import raw materials which ultimately hits the pockets of the consumer as the inflated costs get passed.

The ringgit retreated from two consecutive days of gains to open lower against the US dollar on Wednesday due to subdued demand as well as the rising geopolitical tensions. Meanwhile the ringgit was traded higher against a basket of other major currencies. This could lead many investors to either try to time currency moves or abstain from global investing as they feel that currency fluctuations may add significant risk.

The Thai baht looks primed to perform better than the Malaysian ringgit in 2019. LOS ANGELES Feb 25 The ringgit recovered against the US dollar at the opening today as higher commodity prices may have averted further declines although heightened global geopolitical tensions continued to weigh on investor sentiment and support the US dollar. Ringgit likely to benefit from weaker US dollar June 9 2019 350 am Raggie Jessy On a Friday-to-Friday basis the ringgit strengthened to 415701620 against the US dollar from 418901920 previously.

At 9am the local currency rose to 418301850 versus the greenback from Mondays close of 417801815. It rose against the Singapore dollar to 309921018 from 310621104 at the close yesterday and appreciated vis-a-vis the British pound to 561756215 from 564556522. A weaker ringgit may have benefited exporters in 2017 but is not expected to have the same positive effect now amid slowing global trade and demand.

It rose against the Singapore dollar to 309921018 from 310621104 at the close yesterday and appreciated vis-a-vis the British pound to 561756215 from 564556522. For the time being expect the ringgit to remain weak near its current level he added. Ringgit opens stronger on support from commodity prices.

Despite overall sector performance falling below market expectations the Malaysian rubber glove sector could experience a stronger 2020 performance on the back of stronger demand arising from Covid. A weak ringgit will supercharge them.

Komentar

Posting Komentar