Us-china Trade Tensions Hurting Ringgit

US equities were weaker Wednesday on a resurfacing of trade tensions as Hong Kong Bill found itself in the middle of US-China trade tensions. By 2019 the trade deficit had.

Us Bars Chinese Owned Telecom Over Security Risks

US-China Trade Tensions Worsen.

Us-china trade tensions hurting ringgit. WASHINGTON Global trade tensions escalated this week as the United States renewed its tariff war with China sending major stock indexes tumbling as fears of an economic slowdown. Data from the US. This comes on back of i heightened risk aversion with US-China trade tensions potentially evolving into a full blown trade war ii possibility of yuan depreciating and iii revision in our OPR expectations from unchanged to 25bps cut it said.

It maintains that trade cooperation is the only way forward and that Washingtons trade protectionism will hurt it as well. October 13th 2020 Shannon Flynn. The local note is now trading at RM406 against the greenback.

Could Disrupt the Tech Industry. The prospects of a trade war between China and the western economies ratcheted up on Sunday as Beijing accused the US of pushing relations towards a. In the latest development in the trade dispute between the US and China the Trump administration has announced a delay to the newly planned 10 per cent tariffs on another 300 billion of Chinese goods until the end of 2019.

Market players are concerned that this as well as the sharp decline in US factory activity indicate that US-China trade tensions is hurting the worlds largest economy he added. The United States has seen increasing tensions and trade conflicts with China. In contrast on Dec 2 2019 it traded at RM41775 to the US dollar.

According to the findings more than a quarter of the US firms surveyed said that they expected US-China trade tensions to last indefinitely compared to about 17 a year ago. Since a recent round of negotiations did not bring about any resolution to the dispute between both countries there is now increasing. The US and China reportedly resume trade talks via a phone call between US Treasury Secretary Steve Mnuchin and Chinese Vice Premier Liu He.

China may pursue recourse through. Dollar this week due to rising market uncertainty amid intensifying. China followed with retaliatory measures over the weekend and the US is anticipated to respond with more levies ahead.

As at 6pm the local unit ended at 425602610 against the. China and the US are set to take action against each other as tensions escalate over trade cyber hacking and espionage as US senior law. In 2017 China exported 505 billion in goods to the United States while.

Since the Asian country is a global leader in the tech industry many experts fear these continuing tensions and trade conflicts will disrupt the field. Meanwhile about a. Phil Blancato CEO of Ladenburg Thalmann Asset Management says no one wants more economic pain in this current environment adding that he would be surprised if the current US China trade.

The Chinese government has vowed. According to the report the two sides discussed a framework for a trade deal or at least a ceasefire to reduce tensions. The Malaysian ringgit was likely to trade sideways against the US.

Chinas Trade Conflict With the US. Meanwhile the US. Once a Source of US-China Tension Trade Emerges as an Area of Calm.

Relationship with China and seeks to address the following issues. On May 10 the US. KUALA LUMPUR July 23 The ringgit reversed yesterdays gains to end slightly lower against the US dollar today as market sentiment was weighed by the escalating tensions between the United States US and China a dealer said.

Asian shares shot up to near two-month highs on Monday on signs the United States and China were toning down their trade war rhetoric while Malaysian Ringgit hit a four-month trough in the first. In the event that trade tensions escalate between the two largest economies. November 9 2018 US and China resume trade talks.

And for what its worth the Phase One trade deal. Goods trade deficit with China continued to grow reaching a record 4192 billion in 2018. National Security Strategy of the United States of America December 2017 The Trump administration has raised a num-ber of concerns about the US.

Hiked tariffs on Chinese goods worth 200 billion from 10 to 25 jeopardizing a trade deal currently being negotiated by the two countries. Last modified on Sun 24 May 2020 1850 EDT. In October 2020 Chinas trade surplus with the US rose 1874 per cent from a.

Chinas trade surplus with the US. HLIB revised its 2019 average ringgit assumption versus the US dollar from 405-415 to 415-420. Was 465 per cent higher than the day Donald Trump took office in January 2017.

The ringgit has strengthened 28 since December 2019 as the risk appetite of investors increases as US-China trade tensions temper. The trade deal is providing a rare point of stability as relations between the United States and China fray over Hong Kong. Meanwhile the ringgit traded lower against other major currencies.

Latest US-China tensions could be the trade version of the end of the world as we know it Published Mon Aug 5 2019 327 PM EDT Updated Tue Aug 6 2019 345 AM EDT Jeff Cox jeffcox7528.

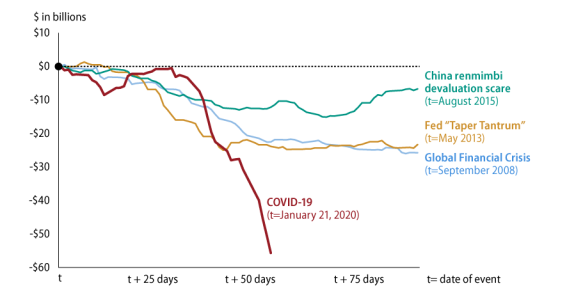

Global Economic Effects Of Covid 19

Komentar

Posting Komentar